Does the value of your stock continue to grow?

Donating appreciated securities, including stocks or bonds, is an easy and tax-effective way for you to make a gift to The Navigators.

The Navigators will use the funds from the sale of your stock toward expanding the ministry—equipping believers to share the transforming power of the Gospel.

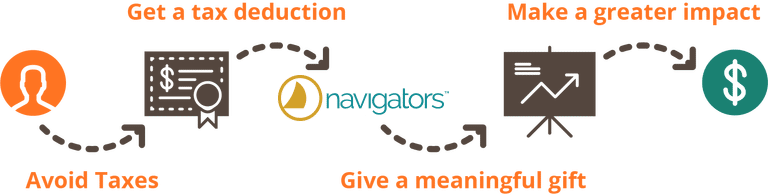

Benefits of Giving Appreciated Stock

- Get an income tax deduction, typically based on asset’s fair market value

- Avoid federal and state capital gains taxes

- Avoid the Affordable Care Act Medicare tax

- Give a meaningful gift to support The Navigators, with no cash out-of-pocket

If you sell your stock, your lifetime investments can be lost to capital gains tax. When you give stock to The Navigators before selling, you won’t pay any taxes, and you’ll receive an income tax deduction for your gift.

How to Give Stock

Download our helpful guide for more information about giving appreciated stock to The Navigators.

- By electronic transfer – Please contact us for instructions on how you can transfer stock or bonds from your brokerage or investment account to The Navigators.

- By certified mail – If you hold securities in certificate form, you will need to mail two envelopes separately to complete your gift. In the first envelope, place the unsigned stock certificate(s). In the other envelope, include a signed stock power for each certificate. You may obtain this power from your broker or bank. Please remember to use certified mail.